Back

Sajin

•

Foundation • 7m

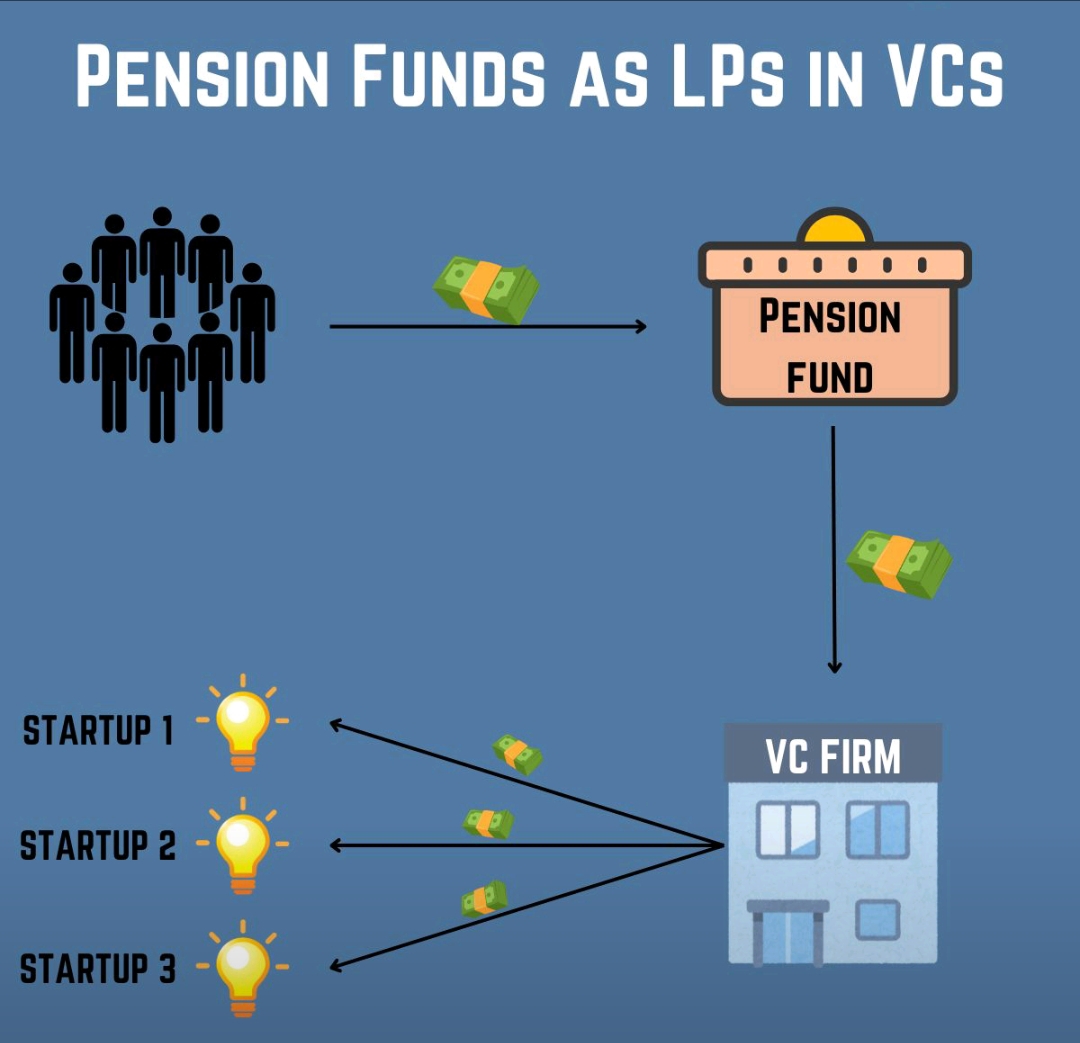

VCs are backbone of startups. How much do you know them? Here are my few insights: 1. VCs invest funds raised from Limited Partners, and accountable to generate them returns in 10 years 2. VCs earn 2% management fee annually from the fund, performance regardless 3. VCs often reserve 50%+ of fund to reinvest winners in later rounds 4. VC model relies on 1-2 unicorns and few late stage exits 5. Expected returns from a startup: 7(+3) years 6. VCs often neglect longterm opportunities due to quicker exits pressure, regardless of profitability or innovation 7. For deal sourcing, VCs rely heavily on networks 8. Branding/PR > consistent returns to attract LP investments for future funds 9. VCs often release funds in tranches 10. VCs push for exits to align fund timelines, regardless of startup maturity For more, Adithya Pappala made an amazing VC series on Medial, check them. As founders, do you find VCs are approachable, or are startups forced to chase clout to win their favor?

Replies (22)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.